With the superposition of multiple factors such as the investment boom in artificial intelligence (AI), global supply concerns, and the weakening of the US dollar, the international copper price is on track to have the strongest performance since 2009. Analysts believe that the upward momentum of copper prices is likely to continue into next year against the backdrop of a tightening supply and demand landscape and accelerating data center construction.

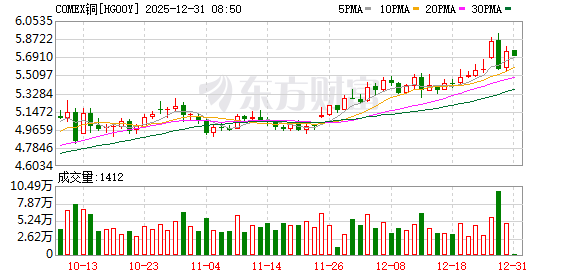

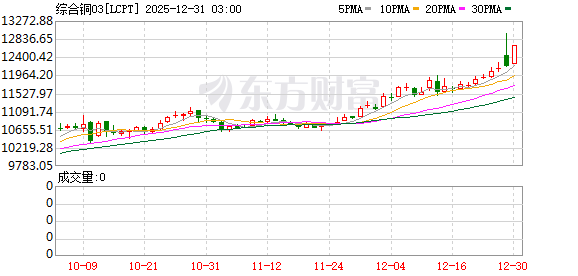

On Tuesday, LME copper prices rose by 2.7%, to $12,550 per ton. In the previous trading session, copper prices touched a historical high of $12,960 per ton. Despite a technical correction in the short term, the overall upward trend for the year remains strong.

So far this year, LME copper has gained about 43% cumulatively, which is expected to create the biggest annual gain since 2009. That year, the global economy gradually recovered after the financial crisis, and copper prices rose by more than 140% for the whole year. On the New York market, copper prices have also risen by more than 40% since the beginning of 2025, also recording the best annual performance in more than a decade.

As a typical periodic metal, copper demand has long been regarded as an important indicator for observing the macroeconomic prosperity. At present, the strategic position of copper in the process of energy transition continues to rise, and it is widely used in electric vehicles, power grid construction, renewable energy and wind power equipment and other fields.

With the continuous improvement of the level of global electrification, the demand for copper has increased significantly with the expansion of power grids, the grid connection of renewable energy and the construction of data centers. Especially driven by the competition of artificial intelligence computing power, large data centers have seen a rapid growth in investment in power transmission, internal wiring and cooling systems, further strengthening the structural demand for copper.

Astris Advisory commodity strategist Ian Roper noted that AI has become one of the latest core factors driving copper prices higher. In a backdrop of tight global supply, the copper market remains "highly tight," with prices having further upside potential.

Roper said the main support for copper prices in recent years has come from green energy and electric vehicle investment. With data centers becoming the new focus of investment, the demand structure for copper is further tilting towards high-value-added areas.

Wall Street investment banks have mixed views on copper prices. JPMorgan, in a research note released in November, said that the imbalance in the inventory structure and the risk of supply disruptions continue to tighten the market, and it expects LME copper prices to remain above $12,000 per ton in the first half of 2026, with an average price of about $12,500 in the second quarter of next year. The bank believes that the growth in demand related to data centers is a "realistic" upside risk factor at present.

In contrast, Goldman Sachs is relatively cautious about the near-term trend. The firm believes that copper prices could experience a corrective pullback after reaching record highs. However, copper prices are supported by continued investment in strategic areas such as power infrastructure, AI, and defense, limiting the downside potential.

Goldman Sachs expects that LME copper prices will mainly trade in the $10,000 to $11,000 per ton range in the near future, with an average price of about $10,710 in the first half of 2026. From a longer-term perspective, the firm remains optimistic about the supply and demand prospects for copper, and expects that by 2035, copper prices could rise to $15,000 per ton, above industry consensus expectations.