This week, the coking coal market experienced a weak downward trend. According to the monitoring system of SunSirs, as of February 20th, the price index of SunSirs's coking coal was 1,509.75 RMB/ton, a decrease of -3.36% from the beginning of the month.

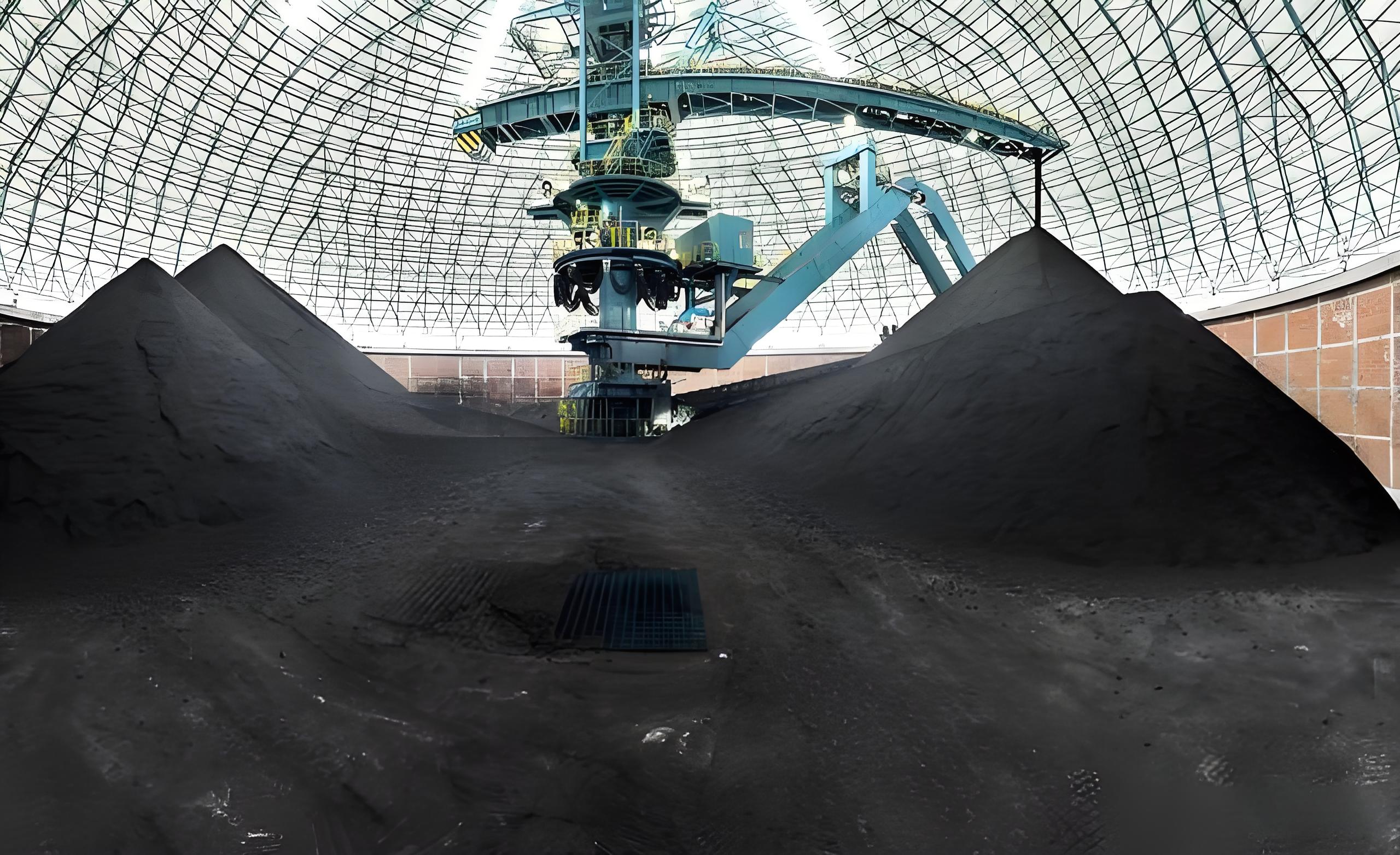

Supply side: Most coal mines have resumed normal production this week, and the supply side is relatively loose.

Downstream: Downstream mainly consumes inventory, weak demand, cold market trading atmosphere, and insufficient support for coking coal. The market tends to adopt a wait-and-see attitude, with a strong bearish sentiment in the future. Overall, the coking coal market prices have been running weakly recently.

According to analysts from SunSirs, the supply side of coking coal has returned to normal, but downstream demand is weak, trading atmosphere is cold, and inventory consumption is the main factor. It is expected that the coking coal market will continue to operate weakly in the later stage, and attention still needs to be paid to the supply and demand situation and building materials transactions in the future.

If you have any enquiries or purchasing needs, please feel free to contact SunSirs with support@sunsirs.com

- 2026-02-13 SunSirs: Die Benchmarkpreise für Kohinkohle und Thermalkohle in SunSirs fallen und steigen am 13. Februar

- 2026-02-13 SunSirs: Preise für Thermalkohle steigen, aber keine Transaktionen; Kohle und Kokzkohle bleiben stabil

- 2026-02-12 SunSirs: Die Benchmarkpreise für Kohinkohle und Thermalkohle in SunSirs fallen und steigen am 12. Februar

- 2026-02-11 SunSirs: Über 70% Wahrscheinlichkeit, dass sich der Preiszentrum des Kohlemarktes im Jahr 2026 nach oben verschiebt

- 2026-02-09 SunSirs: Störungen auf der Angebotsseite in Übersee entstehen, Kohleangebot und Nachfrage werden in den nächsten 3 - 5 Jahren eng bleiben