SunSirs: On January 13th, the Domestic Cobalt Market Is Weakly Consolidating

January 13 2026 15:06:57 SunSirs (John)

|

Variety/Specification |

Quote market/region |

Quote: |

average |

change |

unit |

|

1# Cobalt |

Guangdong Nanchu spot |

446,000-466,000 |

456,000 |

-1,000 |

RMB/ton |

|

1# Cobalt |

Shanghai Metal Network |

456,000-465,000 |

460,500 |

-2,000 |

RMB/ton |

|

Electrolytic Cobalt (99.8%) |

Shanghai Huatong spot |

456,000-466,000 |

461,000 |

0 |

RMB/ton |

|

Cobalt (250kg/drum 99.95%) |

Domestic/Zambia |

452,000-460,000 |

456,000 |

-4,000 |

RMB/ton |

|

Cobalt powder (-200 mesh, domestic) |

Shanghai area |

540,000-570,000 |

555,000 |

0 |

RMB/ton |

|

Electrolytic cobalt |

Shanghai Gold Collection (Domestic Delivery) |

457,000-453,000 |

453,000 |

-4,000 |

RMB/ton |

Price trend

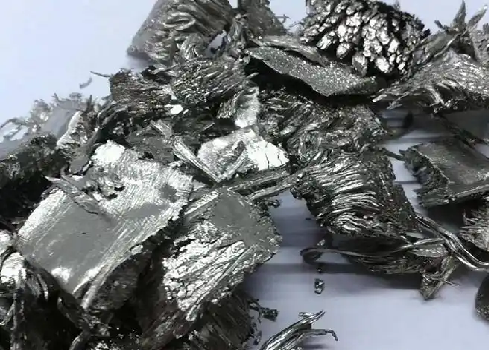

On January 13th, the domestic price of metallic cobalt is quoted at 446,000-466,000 yuan/ton. The price remains weak and fluctuates within a narrow range, indicating a volatile and consolidating market for cobalt.

Market Analysis

The production, installation, and sales of ternary batteries are experiencing slow growth, leading to a slow increase in demand for cobalt. The Congolese government has introduced an export quota system, requiring cobalt exporters to prepay 10% of mining royalties. Cobalt exports from the Democratic Republic of Congo have resumed, and cobalt is officially being shipped from Congolese ports. This alleviates the shortage of cobalt supply, but expectations of rising costs remain. Cobalt miners are reserving export quotas for 2025. New production capacity for cobalt products in Indonesia, coupled with cobalt recycling, partially compensates for the supply shortage of cobalt raw materials, but an overall supply shortage persists. Rising cobalt salt and lithium cobalt oxide prices continue to support a positive outlook for the cobalt market. The strong and stable international cobalt price is weakening the positive impact on the domestic cobalt market, while negative factors remain. Overall, the upward momentum in the cobalt market is weakening, and downward pressure persists.

If you have any inquiries or purchasing needs, please feel free to contact SunSirs with support@sunsirs.com.

- 2026-01-13 SunSirs: The Impact of U.S.–Venezuela Tensions on Non-Ferrous and Precious Metals Markets

- 2026-01-09 SunSirs: Can Digital Mining Save China from a 10x Critical Minerals Shortfall by 2050?

- 2026-01-06 SunSirs: Cobalt Prices Surged in 2025, and Here's the Outlook for Cobalt Price Trends in 2026

- 2026-01-04 SunSirs: A Calm Reflection Behind the Surge in Precious Metals

- 2025-12-26 SunSirs: November China Cobalt Import Data Released