SunSirs : Multiple Factors Converge as Nonferrous Metals Poised for Sustained Bull Run

January 07 2026 10:23:46

SunSirs : Multiple Factors Converge as Nonferrous Metals Poised for Sustained Bull Run

Since the start of 2026, the “nonferrous bull” has shown no signs of slowing, with several leading Chinese stocks hitting all-time highs. After this sustained surge, whether the nonferrous metals sector can maintain its strength has become a focal point of attention across industries.

Geopolitical tensions reignite, prolonging the resource bull market. Analysts suggest that in 2026, global asset pricing logic will shift from “risk aversion” to “anti-fragility” and “recovery.” Amid the convergence of three major waves—technological revolution, fiscal expansion, and supply chain restructuring—non-ferrous metals may emerge as the most compelling asset class of the year.

Macroeconomically, we are in a phase of dual-cycle resonance: overseas rate cuts coupled with domestic easing. Overall, the global cycle of declining interest rates creates an exceptionally favorable environment for globally priced nonferrous resources. Simultaneously, 2026 marks the opening year of China's 15th Five-Year Plan, where sustained easing policies and various initiatives may be anticipated. Secondly, on the supply side, global resource constraints are becoming increasingly evident. The underlying narrative is that resource nationalism is accelerating amid deglobalization trends. The spread of resource nationalism will significantly raise upstream resource acquisition costs, while concerns over supply chain uncertainties will prompt demand-side nations to substantially increase safety stock levels. Finally, demand in emerging sectors continues to resonate under supply constraints. This round of non-ferrous metal performance stems from demand in emerging fields like AI computing power, robotics, and energy storage. Crucially, this resonance hinges on a key premise: demand in these sectors not only grows at exceptionally high rates but also demonstrates far greater-than-expected price tolerance for commodities.

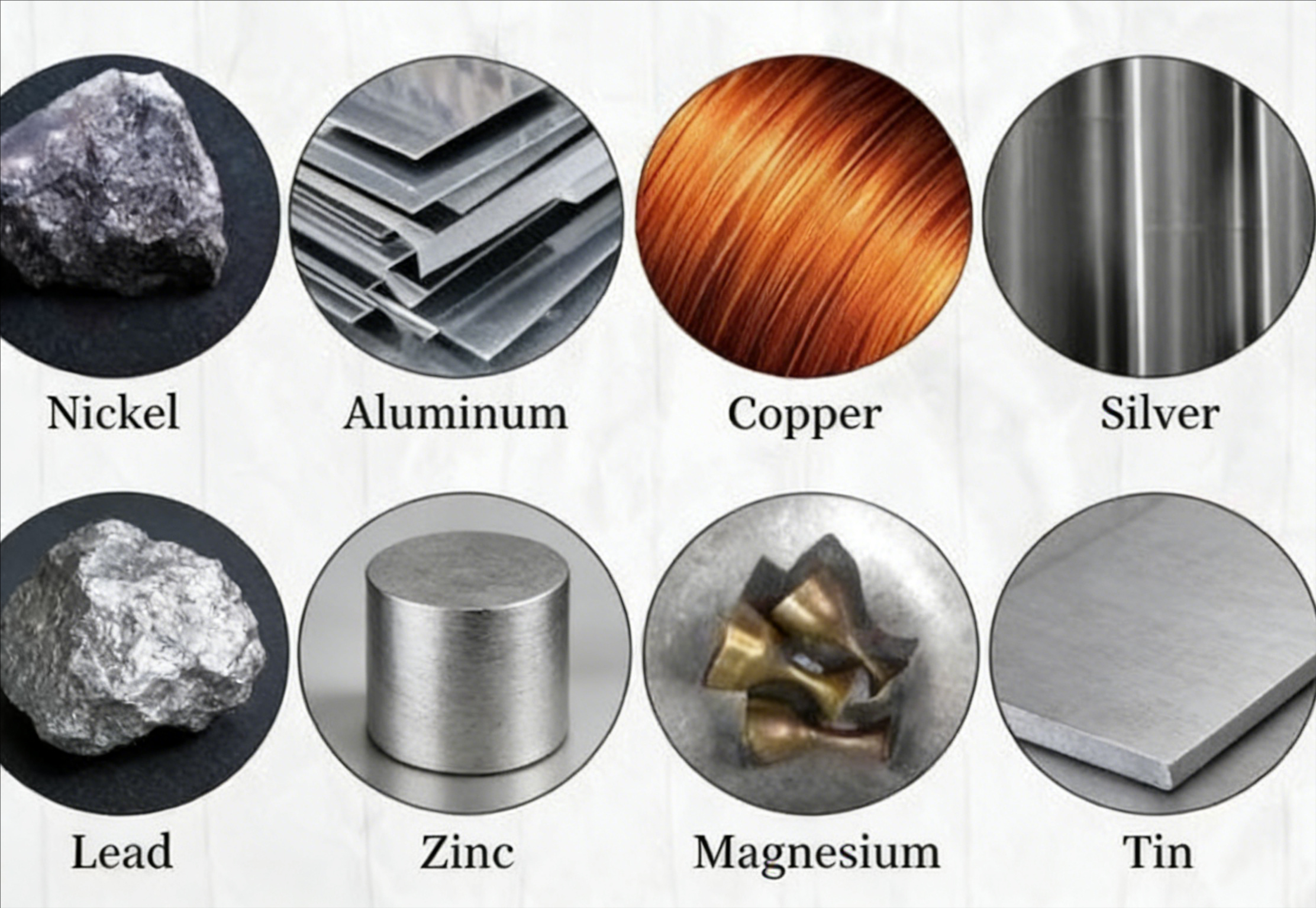

Specifically: - Precious metals like gold, driven by dual forces of “interest rate cuts + de-dollarization,” are expected to retain strategic overweight value. - Industrial metals including copper, aluminum, and nickel may continue their “volatile upward trend” amid competing pressures from “supply disruptions + fiscal expansion + energy transition.” - Energy metals like lithium, fueled by expanding energy storage demand, are poised for a new cycle. Strategic minor metals, however, may still face supply contraction risks from resource-rich nations.

Despite current valuations leaning toward the higher end after the sustained strength of the nonferrous metals sector, three key drivers will continue to unfold: overseas interest rate cuts, China's accommodative macro environment, and the convergence of supply constraints amid deglobalization and demand from emerging sectors. The major nonferrous metals cycle remains on track through 2026.

Although the non-ferrous metals sector holds promising long-term investment prospects, a comprehensive assessment indicates the sector remains within the broader cyclical evolution. Amidst a once-in-a-century transformation, it is inadvisable to apply historical strong-cycle frameworks simplistically; instead, an objective perspective grounded in the current era is essential.

If you have any inquiries or purchasing needs, please feel free to contact SunSirs with support@sunsirs.com.

- 2026-02-13 SunSirs: Indonesia's 30% Cut in Nickel Ore Quotas Triggers Global Price Surge; Domestic Nickel Producers with Mines Benefit, While Pure Smelting Faces Pressure

- 2026-02-13 SunSirs: Multiple Factors Underpin Precious Metals' Long-Term Uptrend, Making Reversal Unlikely

- 2026-02-12 SunSirs: Fed Chair Nomination Sparks Hawkish Expectations; Silver Prices Primarily Undergo Volatile Adjustments

- 2026-02-12 SunSirs: Analysis of LME Metal Inventory Changes on February 11

- 2026-02-12 SunSirs: Nickel Prices Surge as Indonesia Cuts Quota for World's Largest Mine