SunSirs : Electrolytic Aluminum Prices Hit Three-Year High

December 30 2025 11:20:17

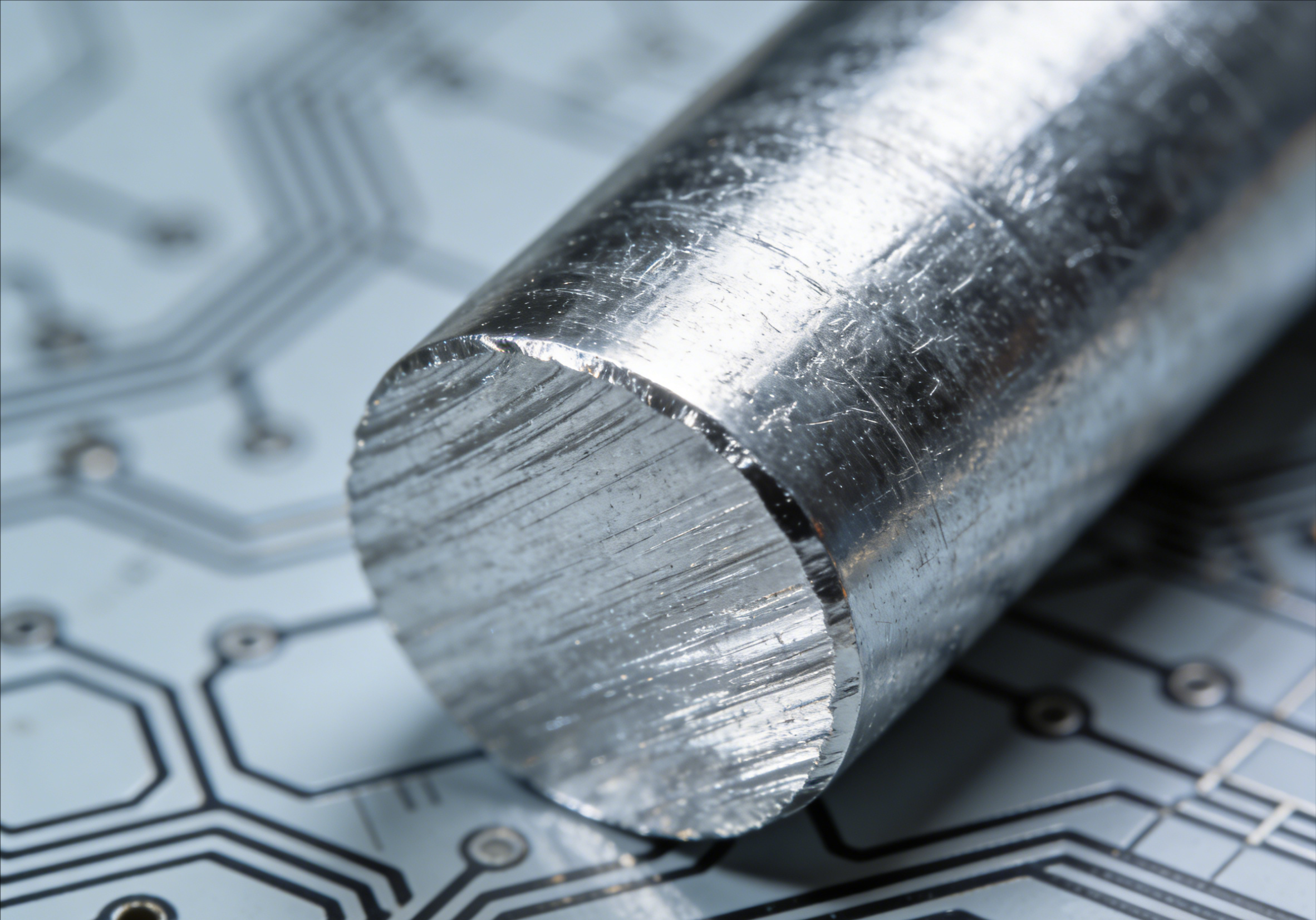

Since 2025, the electrolytic aluminum market has maintained a persistently tight supply-demand balance, driving the industry into a strong upward trend. Shanghai aluminum futures briefly touched 22,400 RMB/ton, hitting a peak not seen since May 2022, while LME aluminum futures simultaneously climbed to a yearly high of $2,920/ton. Monitoring shows domestic mainstream electrolytic aluminum (Al≥99.7%) spot prices have firmly surpassed the 22,000 RMB/ton threshold, marking a three-year high. Driven by multiple factors—a capped production ceiling, new energy demand, and cost-side dividends—the electrolytic aluminum industry is entering a golden development period characterized by synergistic growth in volume, price, and profit. Leading enterprises are continuously expanding their profit margins by leveraging their capacity advantages and integrated industrial chain layouts.

From the supply side, China's electrolytic aluminum industry has entered an era of “existing capacity replacement,” where rigid production constraints have become the core market support. In recent years, constrained by both the industry consensus against overcapacity and carbon peak policies, China's electrolytic aluminum capacity ceiling has been capped at around 45 million tons. Industry estimates indicate that net domestic capacity additions in 2025 will be only 200,000 tons, with a foreseeable total incremental capacity of just 560,000 tons. Even the 500,000 tons of capacity expected to be activated from existing facilities in 2026 will be insufficient to effectively supplement market supply. Overseas, while countries like India and Indonesia are advancing new capacity projects, factors such as unstable power supply mean these facilities are unlikely to operate at full capacity upon completion in 2026. Concurrently, the persistent price differential favoring domestic over imported aluminum makes import opportunities unlikely in the short term. This prevents overseas supply increases from reaching the domestic market, further exacerbating the tight supply situation.

Structural upgrades on the demand side provide sustained upward momentum for electrolytic aluminum prices. The decline in aluminum consumption in traditional construction sectors continues to narrow, while demand growth in the new energy sector emerges as the core driver. The new energy vehicle industry maintains high growth, with per-vehicle aluminum usage rising due to lightweighting trends. Accelerated ultra-high voltage (UHV) grid construction drives significant growth in aluminum cable demand. The substitution of aluminum for copper in power and electronics sectors continues to accelerate, further expanding electrolytic aluminum's application scope. The BuyChemPlast Research Institute forecasts that China's primary aluminum consumption will maintain positive growth in 2025 and 2026, with demand growth reaching 2.1% respectively—exceeding the 1.6% supply growth rate during the same period. This widening supply-demand gap will support a steady upward shift in aluminum price levels.

Cost-side dividends have become a key driver of profit expansion in the electrolytic aluminum industry. As critical cost components, upstream raw materials like alumina and prebaked anodes have seen sustained price declines this year due to ample spot supply. Taking alumina as an example, the main domestic alumina futures contract 2601 fell below the 2,500 RMB/ton threshold on December 10, nearly halving from its peak a year ago. Driven by falling costs and rising prices, the aluminum smelting sector's profit margins have expanded continuously, with high profitability potentially becoming the new norm.

Leading companies demonstrate dual characteristics of stable profitability and improved cash flow. In the first three quarters of this year, Chalco led the industry with a net profit attributable to shareholders of RMB 10.872 billion, setting a new record for the same period in history and marking a 20.65% year-on-year increase. Companies like Yunnan Aluminum Co., Ltd. and China Energy Investment Corporation all reported net profits attributable to shareholders exceeding RMB 3 billion, while Zhongfu Industrial and Jiaozuo Wanfang saw year-on-year increases of 63.25% and 71.58%, respectively. Notably, leading companies are further consolidating their capacity advantages through M&A expansion. For instance, Yunnan Aluminum Co., Ltd. achieved revenue of RMB 16.901 billion from electrolytic aluminum products in the first half of this year, a year-on-year increase of 22.13%. It is currently enhancing capacity through acquisitions and integration while coordinating resource allocation within the Chinalco Group.

In the future, the electricity industry will continue to balance supply and demand, and the long-term growth of demand in the new energy industry will be the core driving force for long-term development. The head office has excellent borrowing ability, the industrial support department has the ability to control the production, and the promising current business will continue to benefit during the high interest rate period. At the same time, the progress of "electronic steel" has been accelerated, the expansion of overseas markets has been accelerated, the electrolytic steel industry has expanded its long space, and the concentration of the industry has also been changed.

If you have any inquiries or purchasing needs, please feel free to contact SunSirs with support@sunsirs.com.

- 2025-12-24 SunSirs: A Review and Outlook of the Aluminum Industry Chain in 2025

- 2025-12-23 SunSirs: Australia, Canada, and India’s Trilateral Agreement Reshapes the Global Governance Landscape for Critical Minerals

- 2025-12-22 SunSirs: Nonferrous Metals Surge Over 75% Year-to-Date; U.S. Rate Cut Cycle Boosts Market Outlook

- 2025-12-15 SunSirs: The Secret Fortune in Mine Tailings: Inside the Trillion-Dollar Waste-to-Wealth Rush

- 2025-12-11 SunSirs: Four Factors Collectively Contributed to the Overall Strengthening of Aluminum Prices in November