SunSirs: Last Week, the Price of Mild Steel Plates Underwent a Downward Adjustment

December 17 2025 09:23:47 SunSirss (John)

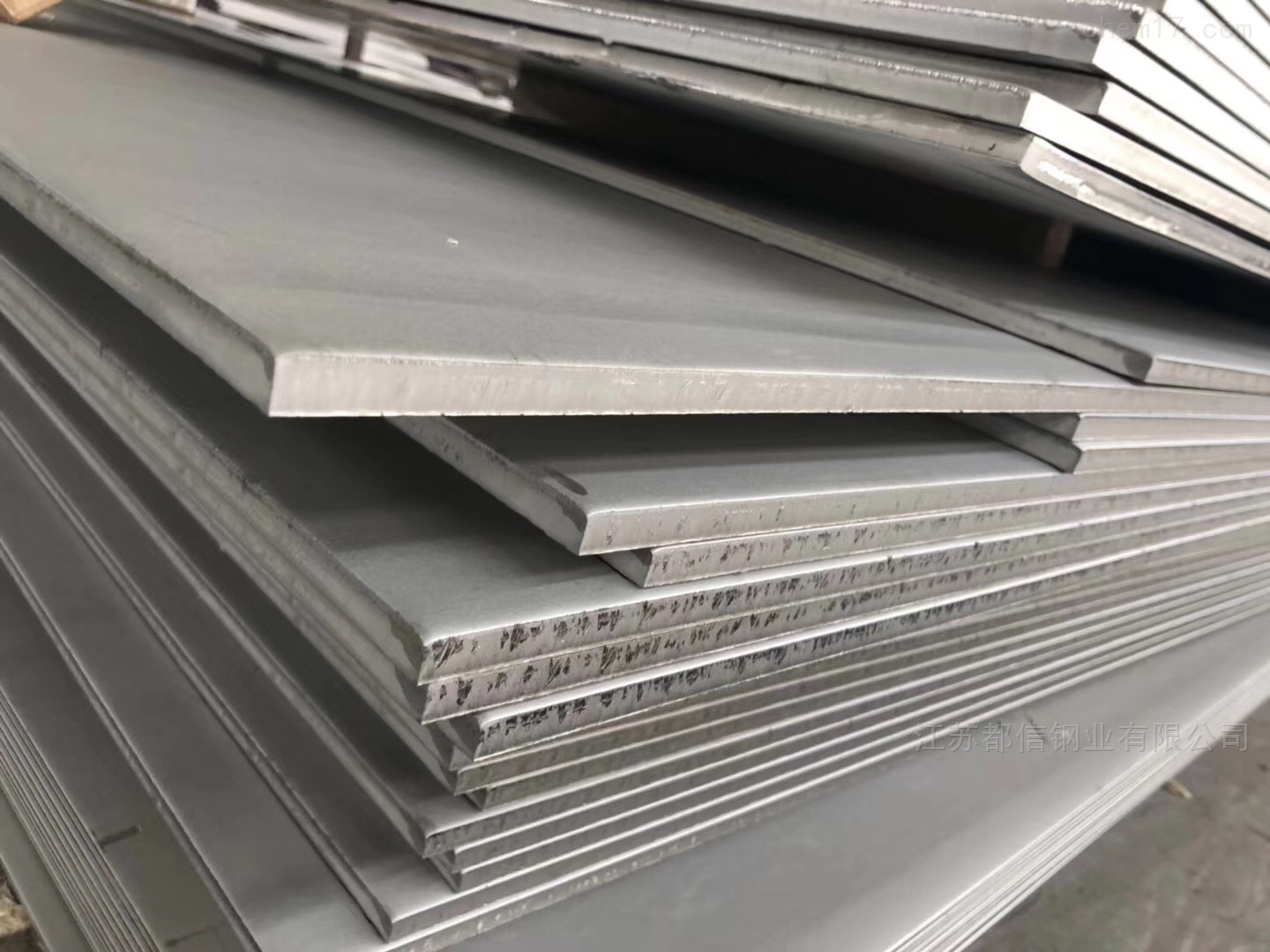

Price trend:

Last week, the price of mild steel plates entered a weaker adjustment phase. Market uncertainty regarding policy details increased, coupled with insufficient demand from end-users, making it difficult for the earlier policy-driven price increases to continue. According to SunSirs' commodity price analysis system, the price of general medium plates (material: Q235B; specification: 20) on December 12th was 3.232 RMB/ton, a decrease of 0.92% compared to Monday.

Influencing Factors

Steel Billet Market: Last week, domestic steel billet prices operated weakly. The price of ordinary billets in Tangshan, including tax, was 2,950 RMB/ton, a decrease of 40 RMB/ton compared to the end of last week. Futures prices fluctuated downwards, and spot prices eased slightly, leading to weaker transaction volumes for lower-priced resources.

Demand side: Last week, demand showed seasonal characteristics of "regional differentiation and overall decline." Affected by the cold wave and heavy snowfall, the construction project commencement rate in Beijing-Tianjin-Hebei, Shanxi, and other regions dropped to below 40%. Procurement volume in downstream industries such as steel structures and construction machinery decreased by 12% week-on-week, and many end-users suspended new purchases. In the Yangtze River Delta and Pearl River Delta regions, pre-holiday construction work was nearing completion. Although apparent consumption was slightly higher than in the north, it still decreased by 0.9% week-on-week, and speculative demand was largely absent, with only essential end-user demand supporting transactions.

Regarding inventory, this week's inventory showed a trend of "slightly increased social inventory, controllable steel mill inventory, and overall lower levels than in previous years." As of December 12th, the total national inventory of mild steel plates was approximately 2.45 million tons, a week-on-week increase of 1.2%, but still 8.3% lower than the same period in the past three years. The East China region continued to see inventory reductions due to accelerated production schedules.

Market Outlook

Coking coal futures fell by over 4%, and the second round of price cuts for coke haf been implemented, weakening cost support. Demand in northern China had further contracted, and construction work in southern China was largely complete, potentially leading to a 2%-3% month-on-month decrease in apparent consumption. However, social inventories remained more than 8% lower than the same period last year, and short-process steel mills were beginning planned shutdowns, which will alleviate inventory pressure. The positive tone of macroeconomic policies remains unchanged, and the market still has expectations for the March meeting. Overall, domestic mild steel plate prices may see a slight correction of 5-10 RMB/ton next week, but low inventory levels and policy expectations will limit the downside.

If you have any inquiries or purchasing needs, please feel free to contact SunSirs with support@sunsirs.com.

- 2026-02-10 SunSirs: The Domestic Market for Mild Steel Plates Showed a Slight Weakening Overall (February 2-6)

- 2026-01-30 SunSirs: Domestic Prices for Mild Steel Plates Showed a Wide Range of Fluctuations in January

- 2026-01-27 SunSirs: Last Week, the Overall Trend of Mild Steel Plates Showed a Slight Downward Trend (January 19-23)

- 2026-01-21 SunSirs: Last Week, the Mild Steel Plate Experienced a Volatile Operation of First Falling and Then Rising (January 12-16)

- 2026-01-13 SunSirs: The Price of Mild Steel Plates Fluctuated by Approximately 10 RMB/Ton Last Week (January 1-9)