SunSirs: 2025 EVA Resin: Global Market Size of RMB30.9 Billion

November 06 2025 11:11:31

According to China Chemical Information Weekly, research statistics from WENKH indicate that the global EVA resin market size will reach approximately RMB 30.968 billion in 2025. It is projected to grow to RMB 35.623 billion by 2032, with a compound annual growth rate (CAGR) of 2.02%.

From General-Purpose Plastic to the “Heart of Photovoltaics”: A Strategic Transformation

Ethylene-vinyl acetate copolymer (EVA), a distinctive high-end polyolefin material, has long played a vital role in sectors such as foam footwear, hot-melt adhesives, and agricultural films due to its exceptional flexibility, elasticity, transparency, low-temperature resistance, and processability.

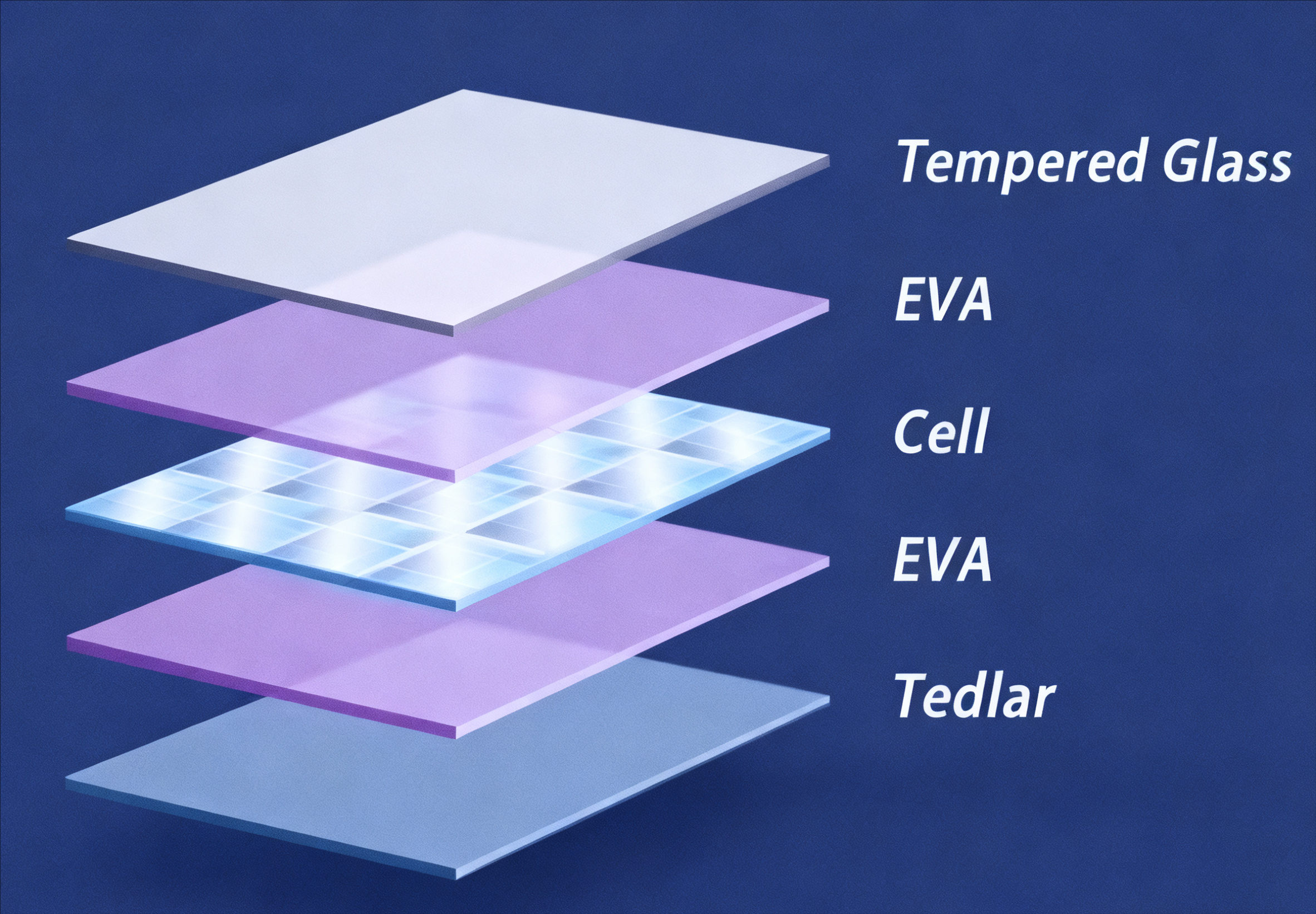

However, over the past decade, the global energy transition has fundamentally reshaped EVA's trajectory. Leveraging its outstanding light transmission, lamination properties, and aging resistance, EVA has emerged as the core raw material for encapsulation films in photovoltaic (PV) modules, accounting for over 90% of film costs. It is hailed as the “hidden champion of the PV industry chain.” This role transformation has not only significantly raised EVA's demand ceiling but also positioned it as a strategic battleground for major chemical industries worldwide.

Global Competitive Landscape: Oligopoly with Technology-Driven Stratified Competition

In 2025, the global ethylene-vinyl acetate (EVA) industry stands at a critical juncture of structural adjustment. As the world's largest producer and consumer of EVA, China's market dynamics profoundly influence global supply-demand dynamics. Despite rapid domestic capacity expansion, the industry faces severe challenges of “high supply and weak demand,” with prices persistently declining and market competition intensifying.

Overall, the global EVA industry exhibits pronounced oligopoly characteristics, with the top five companies collectively controlling over 60% of market supply. High capital investment and technological barriers have formed strong industry moats. Regarding the competitive landscape among leading players, international giants and Chinese domestic enterprises have adopted differentiated strategies:

International giants leverage technological advantages to dominate the high-end market. As the global leader in EVA, ExxonMobil reached a production capacity of 1.5 million tons in 2023, holding approximately 22% of the global market share. with production bases across North America and Europe. Its product portfolio spans high-, medium-, and low-VA content grades, particularly holding technological monopoly in medical-grade products exceeding 40% VA content. It plans to increase bio-based EVA capacity to 20% of total output by 2026. Companies like Dow Chemical and BASF focus on specialty EVA development, maintaining premium pricing power in eco-friendly and high-performance segments. BASF and Mitsui Chemicals collectively hold over 70% of China's high-end catalyst market, establishing upstream core technology dominance. South Korea's LG Chem and Lotte Chemical leverage cost advantages and regional market proximity to compete directly with Chinese firms in foam-grade and photovoltaic-grade EVA. Lotte Chemical's 500,000-ton-per-year capacity primarily employs solution polymerization to produce high-end foam materials, capturing approximately 7% of the global market share.

Domestic Leader with Rapid Capacity Expansion

Chinese domestic enterprises are characterized by capacity expansion and dominance in the mid-to-low-end market. Sinopec Group, as China's leading EVA producer, boasts an annual capacity of 1.2 million tons and holds approximately 18% of the global market share. Its production is concentrated in downstream demand-intensive regions like the Yangtze River Delta and Pearl River Delta, leveraging supply chain integration to ensure stable supply of mainstream products such as photovoltaic materials and footwear materials. Private enterprises like Lianhong New Energy and Sinopec Serbon Petrochemical have overcome technical bottlenecks through independent R&D. Lianhong New Energy's autoclave process has achieved over 85% capacity utilization, boosting its domestic market share to 15%. Its rapid responsiveness to photovoltaic industry demand has secured a competitive edge in niche markets. Since 2025, new domestic capacity additions have accelerated. Beyond Lianhong New Energy's planned fourth-quarter launch of over 200,000 tons of new capacity, major projects like Zhejiang Petrochemical's 700,000-ton LDPE-EVA facility have entered implementation phases, driving China's growing influence in the global production landscape.

China's EVA Development Landscape: From Import Dependency to Growing Pains Amidst Capacity Surge

China's EVA industry embodies a classic industrialization narrative of “introduction, digestion, absorption, and re-innovation,” yet its journey has been fraught with challenges.

Supply and Demand Evolution: From Severe Shortage to Structural Oversupply

High Import Dependence Period (Before 2020): Before the photovoltaic industry boom, China's EVA production capacity was limited, with a self-sufficiency rate consistently below 40%. High-end photovoltaic materials were almost entirely imported from South Korea and Taiwan.

Capacity Investment Boom Period (2021-2024): With the establishment of "dual carbon" targets, the photovoltaic industry entered a super cycle, and EVA prices soared to over 30,000 RMB/ton. Huge profit margins spurred a massive influx of capital, sparking a domestic EVA project construction boom. Companies such as Sirbon (Shenghong Group), Lianhong New Technology, Zhejiang Petrochemical, Gulei Petrochemical, and Zhongke (Guangdong) Refining & Chemical became the main forces driving capacity expansion.

Supply and Demand Reversal Period (2025): With the concentrated release of new capacity, China's EVA production capacity rapidly increased. By 2025, total domestic capacity had exceeded 5 million tons/year. However, the estimated consumption in 2025 was only 3.6 million tons. Downstream demand is showing a pattern of "photovoltaic dominance and weak traditional demand."

The photovoltaic sector, as the largest demand driver, accounts for over 35% of total EVA consumption. In October 2025, the supply of photovoltaic materials was approximately 140,000 tons, while demand was only 130,000 tons, marking the first time a supply exceeded demand. This was mainly due to a decline in photovoltaic module production. From January to August, China's cumulative photovoltaic module exports reached US$15.881 billion, a year-on-year decrease of 24.06%, leading downstream encapsulant film companies to be cautious in their procurement, focusing primarily on clearing existing inventory.

Demand in traditional sectors is showing a divergent trend. The hot melt adhesive sector benefits from the development of e-commerce and cold chain logistics, maintaining a growth rate of 8% to 10%. In 2023, the global EVA market size for packaging was US$2.5 billion, with China contributing 40% of the share. However, high-end hot melt adhesive EVA still relies on imports. Traditional sectors such as foamed shoe materials and cables are affected by the macroeconomic environment. The expected peak season of "Golden September and Silver October" in 2025 failed to materialize, and insufficient orders led to a significant drop in the price of flexible materials, becoming a major driver of the overall weak EVA market in October.

Industrial Structure Challenges: Low-End Competition and High-End Shortage

Although China's EVA production capacity ranks among the world's top, structural supply-demand imbalances are prominent. In October, the prices of mid-to-low-end products such as flexible and rigid EVA materials fell more sharply than those of photovoltaic materials, while the prices of high-end medical-grade and environmentally friendly products remained stable, indicating a persistently high import dependence.

Severe Homogeneous Competition: Most newly commissioned plants use the tubular process, resulting in a product structure biased towards general-purpose grades such as foaming materials and cable materials. When this capacity is released in a concentrated manner, a "price war" inevitably occurs in the mid-to-low-end market, which is the core reason why the price drop of flexible EVA materials far exceeded that of rigid EVA materials in October.

High-End Products Still Need Breakthroughs: In the fields of the highest-end photovoltaic materials (especially top-grade materials suitable for N-type modules) and high-VA content high-end hot melt adhesives, only a few leading domestic companies such as Sirbon and Lianhong New Technology can achieve stable batch supply. The overall quality still lags behind imported products, and some top-end demands still need to be met by imports. The domestic application of the autoclave process, which has the highest technological barriers, remains a long and arduous task.

Conclusion: The global EVA market is undergoing a restructuring, characterized by "Asian capacity expansion and European and American high-end leadership." China has become a core variable in the global market due to its large-scale production capacity, but it still lags behind international giants in terms of technological sophistication and product differentiation. In terms of current development, China's EVA industry has achieved a breakthrough in "quantity," ranking first globally in capacity, output, and consumption. The localization of core equipment has broken the foreign monopoly, and mainstream products such as photovoltaic materials have achieved self-sufficiency. However, improving "quality" remains a long and arduous task. High dependence on imports for high-end catalysts and specialty products, coupled with a prominent structural imbalance between supply and demand, persists.

As an integrated internet platform providing benchmark prices, on November 6, the benchmark price of EVA from SunSirs was 10,700.00 RMB/ton, a decrease of 1.53% compared with the beginning of the month (10,866.67 RMB/ton).

Application of SunSirs Benchmark Pricing:

Traders can price spot and contract transactions based on the pricing principle of agreed markup and pricing formula (Transaction price=SunSirs price + Markup).

If you have any inquiries or purchasing needs, please feel free to contact SunSirs with support@sunsirs.com

- 2026-01-28 SunSirs: Downstream Replenishment, China EVA Market Trend Has Slightly Increased Recently

- 2026-01-20 SunSirs: Impact of Canceling Export Tax Rebates on the EVA Market

- 2026-01-07 SunSirs: Plastics and Rubber Industries Bulk Commodity Intelligence (January 7, 2026)

- 2026-01-05 SunSirs: China Domestic EVA Market Experienced a Downward Trend in 2025, with Increased Supply and Stable but Weak Demand in 2026

- 2025-12-26 SunSirs: China Shandong EVA Market Is Weak and Prices Are Falling