SunSirs: Narrow Range Fluctuations in China SBR Market

August 12 2025 09:24:06 SunSirs (Selena)

Recently (8.1-8.11), the SBR market has fluctuated narrowly. According to the Commodity Market Analysis System of SunSirs, as of August 11th, the price of SBR in the East China market was 12,091 RMB/ton, a decrease of 0.14% from 12,108 RMB/ton on the first day, and the low point during the cycle was 12,008 RMB/ton. The prices of raw materials butadiene and styrene have narrowed, and the cost of SBR continues to be weakly supported. The downstream tire production is basically stable, providing strong support for the demand for SBR; The overall production of SBR is stable, and supply pressure still exists. Recently, supplier prices have been adjusted downwards and then upwards. As of August 11th, PetroChina Northeast SBR 1502 reported a factory price of 121,00 RMB/ton, and the market is observing and raising prices. As of the 11th, the mainstream market price of 1502 SBR in Fushun, Jihua, Yangzi, and Qilu in East China is around 12,000-12,400 RMB/ton.

Recently (8.1-8.11), the prices of raw materials butadiene and styrene have been adjusted narrowly, and the cost support of SBR has remained stable. According to the Commodity Market Analysis System of SunSirs, as of August 11th, the price of butadiene was 9,083 RMB/ton, an increase of 0.37% from 9,050 RMB/ton on the 1st. The high point during the cycle was 9,100 RMB/ton, and the low point during the cycle was 8,916 RMB/ton; As of August 11th, the price of styrene was 7,640 RMB/ton, a decrease of 0.08% from 7,646 RMB/ton on the 1st, and the low point during the cycle was 7,564 RMB/ton.

Recently (8.1-8.11), the domestic SBR plant has been operating steadily, with a start-up rate of around 7.3%.

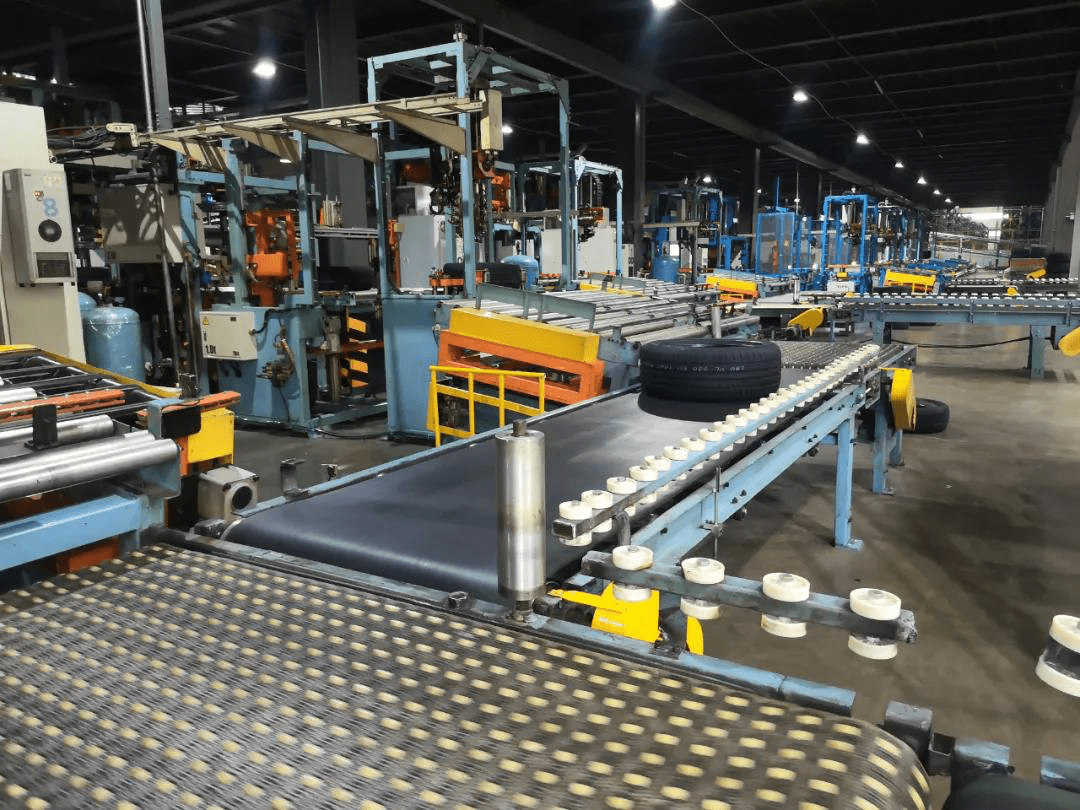

Supply and demand side: Recently (8.1-8.11), the overall stability of downstream tire production has provided essential support for the SBR market. As of August 8th, the construction of semi steel tires by domestic tire companies has slightly increased to around 72%; The construction of all steel tires by tire companies in Shandong Province has slightly increased to around 63%.

From a fundamental perspective, analysts from SunSirs believe that the current cost of SBR will continue to have weak support; The stable supply pressure of SBR production still exists; The downstream tire industry provides strong support for SBR. The peak season is approaching, and overall, it is expected that the SBR market will fluctuate and rise in the later period.

If you have any enquiries or purchasing needs, please feel free to contact SunSirs with support@sunsirs.com.

- 2025-12-04 SunSirs: East China SBR market is weak, prices are lowered

- 2025-12-03 SunSirs: The Benchmark Prices of China BR and SBR Fall on December 3

- 2025-12-02 SunSirs: China SBR market is running weakly

- 2025-12-01 SunSirs: The Cost Has Decreased, China SBR Market Has Weakened and Fallen in November

- 2025-11-27 SunSirs: Global Light Vehicle Sales Growth Boosts Rubber Market