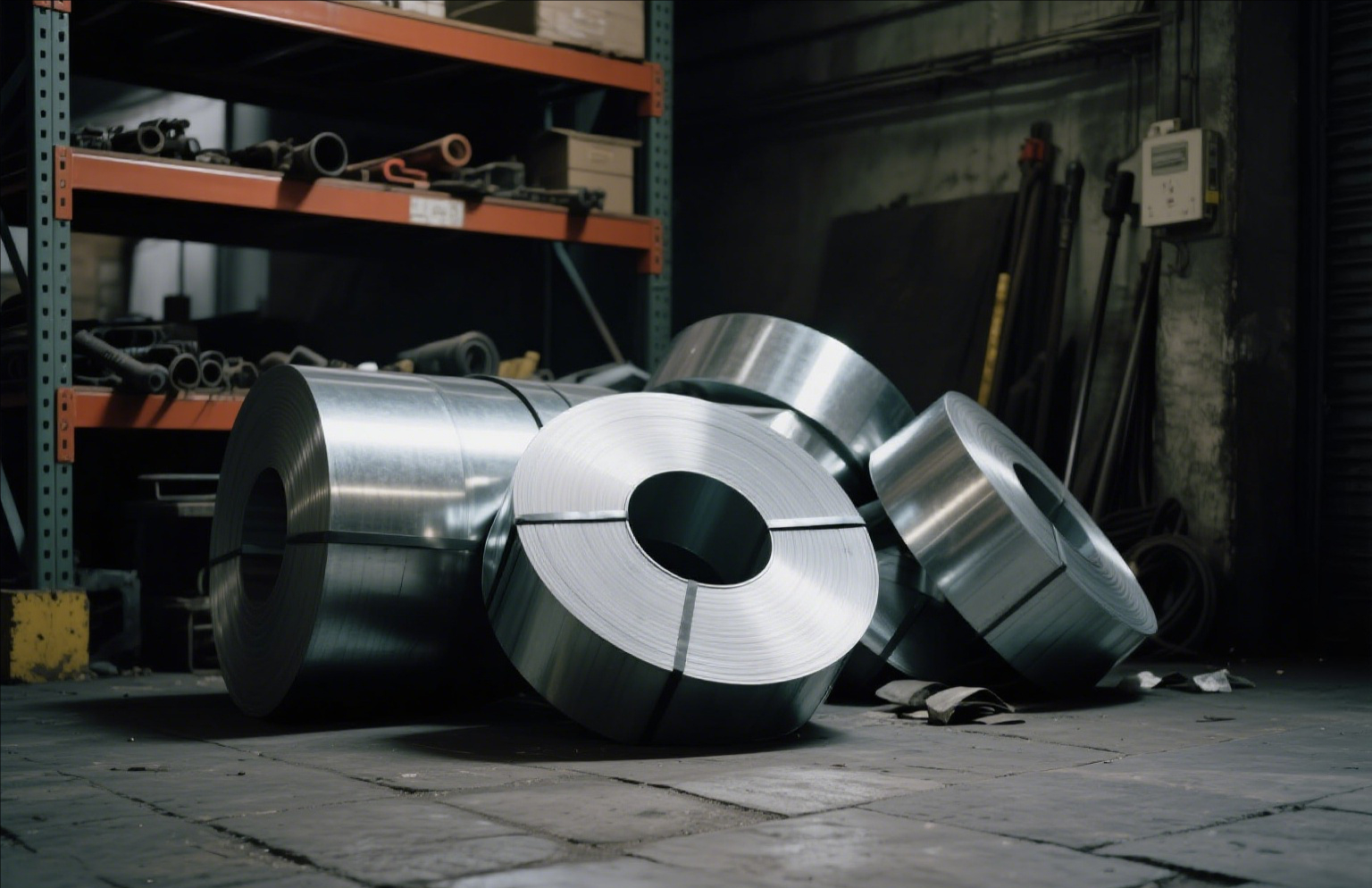

SunSirs: The price of Galvanized Sheet and Coil may be under Downward Pressure

June 03 2025 09:42:38

1. Price analysis

In May, the overall operating rate, capacity utilization rate and output of galvanized sheet and galvanized coil increased, but the demand in the real estate and home appliance industries was not good, the supply was strong and the demand was weak, and the inventory clearance rate slowed down. In May, affected by the poor demand, the trading atmosphere of the galvanized sheet and galvanized coil market became cold, the transaction volume showed a significant decline, the shipment of steel mills and traders was not smooth, and the spot price of galvanized sheet and galvanized coil fell weakly.

According to the commodity market analysis system of Sino-Sino, as of May 30, the average market price of domestic galvanized sheet and galvanized coil was 4137.50 RMB/ton, a month-on-month decrease of 3.61%.

2. Factors affecting price changes:

The capacity utilization rate of galvanized sheet and galvanized coil has slowly recovered

From the weekly output and capacity utilization rate of galvanized sheet and galvanized coil, it can be seen that since the end of the Spring Festival holiday this year, the weekly output and capacity utilization rate have been in a slow upward trend. The average capacity utilization rate of galvanized sheet coils from January to April 2025 was 58.99%, lower than 63.93% in the same period last year.

As of May 30, according to incomplete statistics, galvanized sheet manufacturers nationwide started 81.97%; the capacity utilization rate was 64.1%, a decrease of 0.07% from the previous week; the weekly output was 914,200 tons, a decrease of 1,000 tons from the previous week; the steel mill inventory was 479,100 tons, an increase of 1,000 tons from the previous week, and the social inventory was 1.1036 million tons, a decrease of 6,000 tons from the previous week.

In the first half of this year, the capacity utilization rate recovered slowly. On the one hand, the market demand was not as expected, and the overall demand for capacity decreased, while the market supply increased instead of decreasing. For example, there were new resources put into production in the central region, which made the market competition more and more fierce, and state-owned steel mills also gave priority to the production of steel for automobiles, home appliances and other varieties; on the other hand, from the perspective of variety profitability, the capacity was not as good as cold-rolled coils, and the price of cold-rolled coils was basically the same as that of private galvanized coils. State-owned steel mills were more willing to produce cold-rolled coils, so the overall galvanized coil capacity utilization rate recovered slowly.

Capacity market transactions were sluggish

The slowdown in macroeconomic growth and the reduction in investment in terminal industries such as real estate and infrastructure have led to obvious signs of contraction in capacity demand. At the same time, the black futures market fluctuated and operated weakly, and the market demand was still dominated by rigid demand purchases. The market terminal's willingness to purchase was average, and the transaction performance was mediocre.

From the perspective of downstream terminals, China's automobile production in April was 2.604 million vehicles, a year-on-year increase of 8.5%; the cumulative production from January to April was 10.116 million vehicles, a year-on-year increase of 11.1%. But we need to note that in March 2025, the year-on-year growth rate was 11.9%, and the output reached 3 million vehicles. In April, the automobile output decreased by 400,000 vehicles month-on-month, a decrease of 13.33%.

In May, the national production capacity transaction volume showed a trend of increasing first and then decreasing, and the overall market activity was poor. From the perspective of the transaction volume of galvanized sheets and galvanized coils, the market performance was relatively sluggish. As of May 26, 154 national galvanizing companies had a total transaction volume of 13,218 tons, a decrease of 736 tons from the previous trading day, a decrease of 5.27%.

Overall, the national cold rolling and capacity market in May was dragged down by the demand side, and the transaction volume growth was weak.

Export

In April 2025, the total export volume of my country's coated sheets (strips) totaled 1.8379 million tons, a month-on-month decrease of 2% and a year-on-year increase of 11.57%. From January to April 2025, the total export volume of coated plates (strips) in my country totaled 6.8695 million tons, a year-on-year increase of 13.9%.

III. Market Forecast

On the whole, the factory has no plan to reduce production for maintenance, and the subsequent production of galvanized plates and galvanized coils may continue to be maintained. Although the settlement price of settlement resources has fallen after this month, traders have reported that they are still in a loss-making state. The order volume in June may decrease. In the later period, resources may be concentrated in the hands of production enterprises. With the arrival of the off-season of high-temperature demand, the analysis of Sino-Trade believes that the price of galvanized plates and galvanized coils may be under pressure to decline.

If you have any enquiries or purchasing needs, please feel free to contact SunSirs with support@sunsirs.com.

- 2026-02-13 SunSirs: Sluggish Growth in Major Appliance Production; Galvanized Steel Sheet and Coil Spot Inventories Remain Elevated

- 2026-02-11 SunSirs: The Market Gradually Came to a Standstill, and the Price of Galvanized Steel Sheets and Coils Was Weak and Stable

- 2026-02-02 SunSirs: High Inventory Coupled with a Delayed Recovery in Demand Led to Downward Pressure on Galvanized Steel Sheets in January

- 2026-01-27 SunSirs: With Supply Exceeding Demand, the Price of Galvanized Steel Sheets and Coils Was Trending Downwards

- 2026-01-22 SunSirs: Trading Activity Was Sluggish, and Galvanized Steel Sheets and Coils Traded Weakly