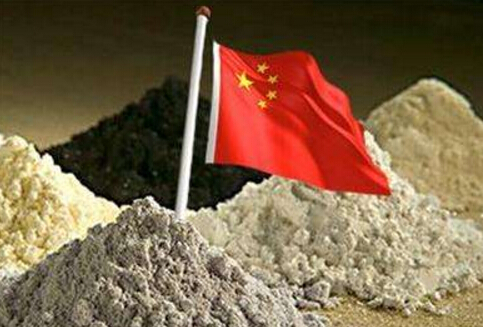

SunSirs: May 8th, analysis of domestic rare earth market price fluctuations

May 09 2020 15:21:07 SunSirs (Molly)

The rare earth index on May 8 was 330 points, which was the same as yesterday, a decrease of 67.00% from the highest point in the cycle of 1000 points (2011-12-06) and a 21.77% increase from the lowest point of 271 points on September 13, 2015. (Note: The period refers to 2011-12-01 to present).

The average price of neodymium metal in rare earth metals is 353.5 thousand yuan / ton; the average price of metal dysprosium is 2.325 million yuan / ton; the average price of metal praseodymium is 635,000 yuan / ton. The average price of praseodymium and neodymium oxide in rare earth oxides increased by 2,000 yuan / ton to 265,500 yuan / ton; the price of dysprosium oxide fell by 5,000 yuan / ton to 1.77 million yuan / ton; the average price of praseodymium oxide was 305,000 yuan / ton; neodymium oxide The average price is 279 thousand yuan / ton. The price of praseodymium and neodymium alloys in rare earth alloys rose by 3500 yuan / ton to 334,000 yuan / ton; the average price of dysprosium iron alloys was 1.775 million yuan / ton.

The rare earth price trend in the rare earth market continued to fall, and the supply of domestic heavy rare earth markets increased. Myanmar unilaterally closed customs clearance ports, but domestic manufacturers continued to resume work, domestic supply increased, and the domestic heavy rare earth price trend continued to fall. Recently, the demand for permanent magnets has declined. The market trend of praseodymium and neodymium products has been slightly lower. The supply on the market is normal. The demand for light rare earth has weakened recently, and prices in some markets have continued to decline. In addition, the recent foreign health incidents have a greater impact, the export volume of rare earth products has fallen sharply, and the price trend of the rare earth market has declined. The price fluctuations in the rare earth market are related to environmental protection inspections nationwide. The production of rare earths is special, especially because some products have radiation hazards, which has made environmental protection regulations more stringent. Under strict environmental protection investigations, manufacturers have reasonably controlled sales, but downstream demand has recently declined and some rare earth prices have fallen.

The Ministry of Industry and Information Technology said that by 2025, the sales of new energy vehicles and new vehicles will account for about 25%. Global electrification is entering the acceleration period of high-quality supply-side models. China's double-point policy and European carbon emission requirements have established a long-term development mechanism for new energy vehicles. Driven by national policies, the supply and demand pattern of the rare earth industry is expected to further improve, China's domestic demand has improved, and the price of heavy rare earth in the domestic rare earth market remains high. Recently, the Ministry of Natural Resources, the Ministry of Industry and Information Technology issued the ‘Notice on Issuing the Total Control Index of Rare Earth Mine Tungsten Ore Mining (First Batch) in 2020’, clarifying the country ’s first batch of rare earth ore (REO) mining total The quantity control index is 66,000 tons, and the tungsten concentrate (tungsten trioxide content 65%) total mining control index is 52,500 tons. National policies are conducive to the balance between supply and demand in the rare earth industry. Recently, the supply of heavy rare earth market has increased, and market prices have dropped slightly.

SunSirs rare earth analysts expect that the domestic heavy rare earth market will be in normal supply in the near future, and the downstream demand will be normal. In addition, the downstream export market will be poor.

If you have any questions, please feel free to contact SunSirs with support@sunsirs.com