SunSirs: Galvanizing rally may continue until mid-June

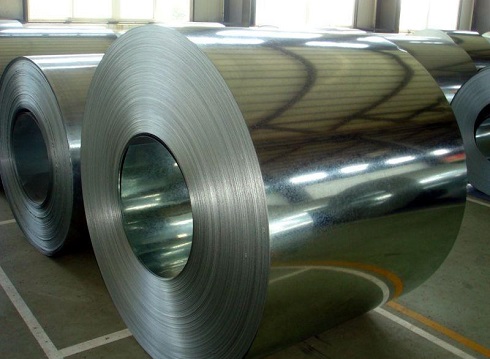

May 29 2020 10:10:40 SunSirs (Molly)Compared with other steel varieties, the "continuous rise" model is different, the domestic galvanizing market's uptrend seems "simple and rough". Judging from the market situation in the past three months, the continuous decline in March and the stabilization of April in April seem to be exactly the same as the trend of the steel mine industry chain. But the price of "anti-Z" suddenly rose, highlighting its "uniqueness".

In early May, domestic galvanized prices rose by only 0.43%, but its upstream products, iron ore, rose by 3.22%, hot rolled coil rose by 2.94%, and metallic zinc rose by 3.62%. However, in the middle of the year, affected by the sharp and continuous rise in cost prices and the continuous rise in the futures market, traders' offers were suddenly raised, with a gain of 3.67% in two days. Later, it started to operate stably. As processed products and slow-selling products in the iron and steel industry chain, the price of galvanized steel will be relatively stable and the fluctuation will be relatively small, but the uptrend is already existing, it will be reflected quickly, mainly once in place.

According to SunSirs price monitoring, as of May 27, the average market price of Shanghai 1.0 * 1250 * C hot-dip galvanized coils was 4,350 yuan / ton, up 4.07% from the beginning of May, down 8.03% year-on-year, and the decline narrowed. Among them, Benxi Iron and Steel 4280-4300 yuan / ton, Handan Iron and Steel 4240-4260, Wuhan Iron and Steel 4480-4500 yuan / ton, Hanbao 4270-4300 yuan / ton, Shougang 4290-4310 yuan / ton, Anshan Iron and Steel 4280-4310 yuan / ton. On the whole, the resource prices of different steel mills are not much different, and the price gap between high and low is also narrower than before.

On the supply side, data shows that as of May 22, of the 266 galvanizing lines in the country, 51 have been overhauled, and steel mills have resumed production at an accelerated rate, but compared to 2019, there is still a gap of nearly 10% . The data shows that the operating rate of steel mills has remained at 78% -80% for 9 consecutive weeks, which shows that although the recent galvanizing prices have rebounded greatly, the enthusiasm of steel mills after the resumption of production has not been active in the continued downturn in the previous period. There has been a clear recovery, only the resumption of production. On the other hand, during the same period, the capacity utilization rate of galvanized steel plants remained basically at around 65%, and the weekly output of the steel plants was in the range of 780,000-800,000 tons, showing that their steel plants are mainly producing on a step-by-step basis, and are not active or cater to. Therefore, from the supply side, the market has not changed much from April.

But it is worth noting the inventory. The data shows that as of May 22, the galvanized social stocks were 125.10 million tons, a weekly increase of 22,700 tons. However, the average weekly inventory in May was 1,256,200 tons, a significant decrease of nearly 100,000 tons / week compared with March and April. The steel mill inventory is 670,000 tons, which is only 15,000 tons / week lower than that in March and April. It can be seen that the inventories of steel mills are relatively stable, and there are no traders who suppress warehouses; while the market consumes more inventory, the demand is gradually rising, supporting prices.

From the perspective of the galvanizing industry chain, the price of hot rolled raw materials has increased, which has formed a supporting effect on the upward trend of galvanizing prices. However, comparing with the downstream of the industry chain, demand is picking up or the main driving force of its upward trend. Among them, the price of color coating rose by 5.53%. In addition, according to data from the China Automobile Association, automobile production and sales in April 2020 increased by 46.6% and 43.5% sequentially, and increased by 2.3% and 4.4% year-on-year. From January to April, automobile production and sales fell by 33.4% and 31.1% year-on-year, and the decline was narrowed by 11.8 percentage points and 11.3 percentage points compared with January-March; The decline was narrowed by 4.4 percentage points from January to March. The housing construction area of real estate development enterprises increased by 2.5% year-on-year, and the growth rate fell by 0.1 percentage points from January to March. Therefore, with the continuous improvement of the domestic epidemic prevention and control situation, the production and sales of the automobile industry have gradually returned to normal levels. The production and sales of the month continued to maintain rapid growth, and also ended a year-on-year decline, showing a slight increase. Although the real estate market data has declined, the decline has narrowed, and it has also formed a favorable market for the market. Therefore, for the galvanizing market, downstream procurement demand may continue to pick up steadily, supporting prices.

Judging from the spot K-line chart, the recent market trend is basically the same as the rebound after the previous plunge, but the market rebound may shrink relatively.

In summary, SunSirs galvanizing analysts believe that the current domestic galvanizing market is a price increase of "supply less than demand". With stable supply, falling inventory, raw material support, and improving demand, prices may continue to rise. In addition, the mill's ex-factory prices in June are still steadily increasing, and traders' recent orders and moving operations may intensify, which has also increased market liquidity and pushed up prices. However, according to the business community, there are currently some steel mills that cannot deliver goods. On the one hand, logistics freight rates have increased, on the other hand, there are sufficient scheduling orders. Therefore, it is expected that the upward trend of galvanizing may continue into the middle and early June, and may stabilize in the second half. Comprehensive evaluation of the market average price is expected to be 4350-4400 yuan / ton.

If you have any questions, please feel free to contact SunSirs with support@sunsirs.com.

- 2023-06-20 SunSirs: National Steel Production in May 2023

- 2023-05-10 SunSirs: China Steel Association: Main Metallurgical Products Import and Export Report Last Month

- 2023-02-17 SunSirs: China Steel Association: the Daily Output of Crude Steel in the first Ten days of February was 2062100 Tons

- 2023-01-31 SunSirs: The Steel Market Welcomed a Good Start, and the Whole Line of Steel Products Rose Sharply

- 2022-11-14 Quotation from Galvanized Sheet Circulation Field on November 13