SunSirs: A Capital Windfall for Chemicals—But Is the Industry Prepared?

January 30 2026 09:48:42 China Energy Network (lkhu)

Lead: Last week, driven by capital inflows, the chemical futures sector saw a surge in sentiment, leading to a variety of opinions in the market. Industry analysts note that amid the "sell America" frenzy, capital is seeking safer-haven assets, and the reason for going all-in on China is that, after weighing the pros and cons, China is not at the center of the storm. Historically, there has been a long-term locked-in correlation between gold and crude oil. With the skyrocketing price of gold, crude oil is severely undervalued, and the valuation of chemical products is being reshaped. From a long-term perspective, products with sound long-term logic, stories, and narratives, particularly the first echelon of aromatics and their downstream polyester series, are expected to continue receiving support. In the short term, given the off-season before the Spring Festival, it will be quite challenging to achieve a value leap from futures to spot markets. There is a need to be wary of a tragic scenario in the last two weeks before the festival, where capital takes profits and withdraws, and downstream sectors experience concentrated negative feedback.

Last weekend, futures varieties in the chemical sector collectively surged, and there are various opinions in the market regarding this: from a cyclical perspective, the five-year cycle of the chemical industry has arrived; from an expectation perspective, there is a mismatch in the capacity expansion cycle (such as PTA); from a valuation perspective, funds from high-valued non-ferrous metals are flowing into low-valued chemicals; from an event-driven perspective, overseas and domestic plants have undergone concentrated maintenance or shutdowns (synthetic rubber, styrene, and ethylene glycol), and so on.

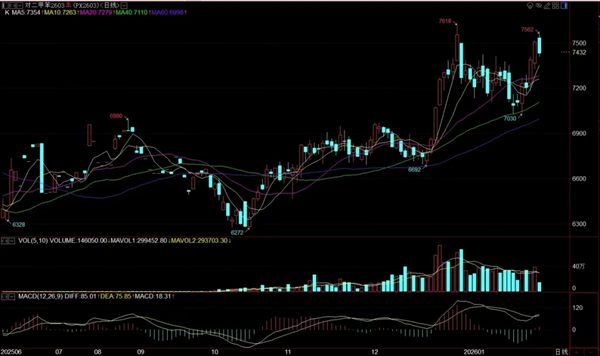

Aromatic chain

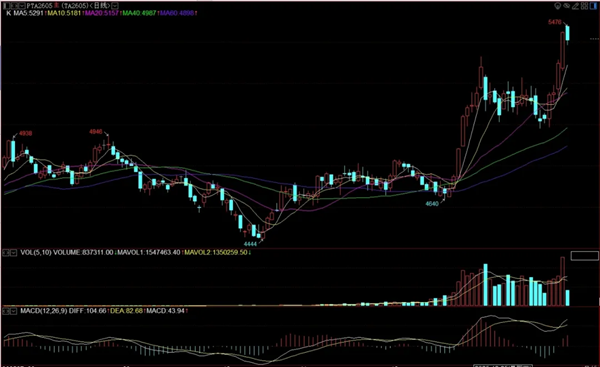

Polyester chain

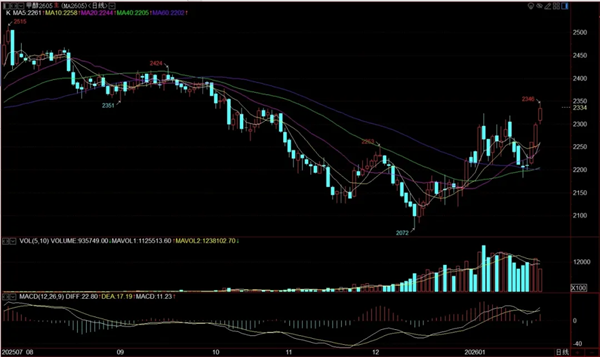

Methanol-olefin chain

Overseas Macro: Amid the "Sell America" frenzy, funds seek safer-haven assets

International geopolitical crises have intensified. Recently, U.S. President Trump imposed a 10% tariff on 8 European countries, though it was dramatically withdrawn later. However, the geopolitical conflicts over Greenland, coupled with the plummet in Japanese government bonds, have triggered a "sell-off of U.S. assets" frenzy. The strength of safe-haven assets has exceeded market expectations, with both gold and silver embarking on a "moon shot" rally. Gold has surpassed the 5,000 mark, while silver has broken through the 100 level.

Meanwhile, capital inflows into China's stock market have hit a record high. The reason for the massive capital influx into China is that, after weighing the pros and cons, China is not at the center of the storm.

Anchor change: Crude oil is severely undervalued, and the valuation of chemical products is being reshaped

In the past, there has been a long-term fixed correlation between gold and crude oil, with the gold/crude oil ratio approximately 15.5:1. However, due to the surge in gold prices, the current ratio stands at 81:1. The international crude oil market has seen a slight increase recently, but overall, it is still in a bottoming-out phase. Undoubtedly, U.S. President Trump will suppress crude oil prices before the mid-term elections.

The costs, profits, and pricing of domestic chemical products, especially oil-based ones, have long been tied to international crude oil. When crude oil is severely undervalued, the valuation of chemical products is reshaped. However, the specific value range requires the running-in and dual selection of the market and capital. From a long-term perspective, products with good stories, the first echelon of aromatics and downstream polyester series are expected to continue to receive support. The second echelon, methanol and rubber, may see intensified fluctuation ranges, and risk management must keep up.

Market bottleneck: How to achieve the value leap from futures to spot goods in the off-season before the Spring Festival?

In 2025, the chemical market will be in a narrow range of fluctuations most of the time under the situation of weak fundamentals in reality plus strong policy expectations. The upward height is firmly constrained by policies that are lower than expected. At present, the inflow of funds has brought a turning point to the futures market, but the threshold for the flow of funds from futures to spot goods will be significantly increased. Moreover, from the perspective of fundamentals, this timing is the lowest point of demand throughout the year. Downstream factories will successively close for holidays, with only the last wave of pre-holiday purchases. In the short term, it is expected that the spot market may passively see price increases and volume declines. We should be particularly vigilant against the tragic situation in the last two weeks before the holiday, where funds are cashed out and withdrawn, and downstream sectors experience concentrated negative feedback.

If you have any inquiries or purchasing needs, please feel free to contact SunSirs with support@sunsirs.com.

- 2026-01-29 SunSirs: Methanol: Supply-Demand Imbalance Expected to Ease

- 2026-01-26 SunSirs: The Methanol Market Was Experiencing Volatile Upward Price Movements

- 2026-01-23 SunSirs: Methanol Market Prices in Some Regions of China on January 22nd

- 2026-01-22 SunSirs: 2025 Methanol Market Review and 2026 Outlook

- 2026-01-22 SunSirs: Improved Methanol Supply-Demand Balance Faces Downward Pressure from Imports