SunSirs: Coking Coal Supply and Demand were Negative, Prices continued to Decline (11.1-11.15)

November 15 2019 18:13:14 SunSirs (Selena)

- Price Trend

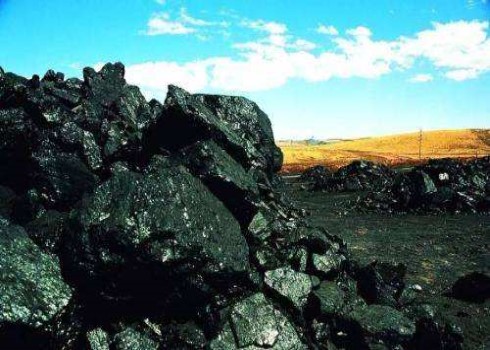

In the first half of November, the domestic coking coal market fell in shock. According to the monitoring of SunSirs, as of November 15, the coking coal fell by 4.18%, At present, the price range including tax is 1,360-1,500 RMB/ ton.

In terms of regions, the price in Hebei Province decreased slightly, ranging from 20-30 RMB/ ton, while that in Shanxi Province was relatively obvious, around 50 RMB/ ton. In addition, the prices in Anhui, Inner Mongolia, Henan and other regions also declined to varying degrees. The reason for the downturn in the market is mainly due to the negative supply side and the lack of timely follow-up of demand. From the data, the significant increase in domestic coal production in October has brought some pressure on the market supply.

- Market Analysis

In terms of supply, both domestic coal output and import volume put pressure on the current market. According to the data of the Bureau of statistics, the output of raw coal in October 2019 was 320 million tons, up 4.4% year-on-year, and the growth rate was the same as that of last month; from January to October, the output of raw coal was 3.06 billion tons, up 4.5% year-on-year. In terms of import, according to the statistics of customs data, from January to September, the cumulative import of coking coal was 60.95 million tons, a year-on-year increase of 19.93%; in September, the import of coking coal was 7.965 million tons, a year-on-year increase of 20.57%. It can be seen from the data that the import growth of domestic coking coal is obvious this year, which has a significant impact on the domestic supply, and there is a certain price advantage in the price of foreign imported coal, which naturally depresses the price of domestic coal, thus, the negative effect brought by the cost side restrains the continued firmness of coking coal price.

In terms of demand, at present, the coking coal market is under the double pressure of oversupply and weak demand. In the policy of heating season in autumn and winter this year, the letter for comment on limiting heating production in autumn and winter was issued, in which there was a clear instruction on coking capacity reduction. The pressure of environmental protection has always been like a sword of Damocles hanging on the head of coking enterprises. It can be imagined that in terms of the implementation of tasks, 24 coking enterprises in Shandong Province reduced coking capacity by 16.86 million tons, including the reduction of task force in 2020 The competition will be completed by the end of April. 10.31 million tons of capacity will be removed by the end of this year.

- Market Forecast

According to the coking coal analysts of SunSirs, at present, both the supply and demand of coking coal are negative, and it is difficult for the fundamentals to show new variables in the short term. The domestic coking coal output at the supply end surges sharply, the imported low-cost coking coal resources have an impact on the market, the demand end comes from the pressure of environmental protection, the downstream enterprises stop production and the double impact of profit compression. Therefore, it is estimated that in the domestic coking coal market Long term prices will remain under pressure.

If you have any questions, please feel free to contact SunSirs with support@sunsirs.com .

- 2024-04-16 SunSirs: China Coking Coal Prices were Weak Last Week (April 7-12)

- 2024-04-01 SunSirs: China Coking Coal Prices were Weak in March

- 2024-03-26 SunSirs: China Coking Coal Prices were Weak Last Week (March 18-22)

- 2024-03-19 SunSirs: China Coking Coal Prices were Weak Last Week (March 11-15)

- 2024-03-15 SunSirs: Daily Report of China Commodity Data (March 15, 2024)