SunSirs: The ‘Polarization’ of Heavy and Light Rare Earth Markets is Obvious Since March in China

March 16 2020 16:26:14 SunSirs (Linda)

In March, the omestic rare earth markets are ‘polarized’. Domestic heavy rare earth prices continue to rise, while light rare earth prices fall. According to the SunSirs Rare Earth Sector Index, the rare earth index on March 12 was 342 points, which was the same as March 11, and was 65.80% lower than the highest point (1,000) of the cycle (December 6, 2011), 26.20% higher than the lowest point (271) on September 13, 2015. (Note: Period refers to December 1, 2011 to present).

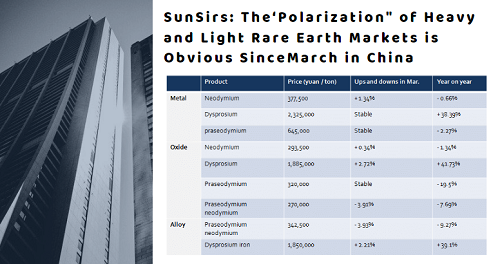

As of March 13, the average price of metal neodymium in rare earth metals in China was 377,500 yuan / ton, with the price trend rising 1.34% in March, down 0.66% year on year; the average price of metal dysprosium was 2,325,000 yuan / ton, with the price trend stable, up 38.39% year on year; the average price of metal praseodymium was 645,000 yuan / ton, with the price trend stable, down 2.27% year on year. In rare earth oxides, the average price of praseodymium neodymium oxide was 270,000 yuan / ton, down 3.91% since March, down 7.69% year on year; the price of dysprosium oxide was 1,885,000 yuan / ton, up 2.72% since March, up 41.73% year on year; the average price of praseodymium oxide was 320,000 yuan / ton, stable in March, down 19.5% year on year; the average price of neodymium oxide was 293,500 yuan / ton, up 0.34% in March, down 1.34% year on year. The price of praseodymium neodymium alloy in rare earth alloy was 342,500 yuan / ton, down 3.93%, down 9.27% year on year; the average price of dysprosium ferroalloy was 1,850,000 yuan / ton, up 2.21% since March, up 39.1% year on year.

Recently, domestic prices of heavy rare earth have continued to rise, leading the rare earth market. The unilateral ban on rare earth exports by Myanmar has caused a sharp decline in domestic heavy rare earth imports, coupled with the fact that some rare earth companies in the south have not yet fully resumed work, the domestic heavy rare earth supply has decreased, the domestic heavy rare earth supply and demand contradiction has sharpened, and the heavy rare earth market prices have risen sharply. Due to the gradual resumption of work by downstream magnetic materials companies, the market demand has picked up, the enquiries are more positive, and the actual transaction situation is acceptable. The prices of major upstream manufacturers have gradually increased, and the market price of medium and heavy rare earth has risen.

The amount of light rare earth in the first batch of rare earth mining indicators in 2020 will increase compared to 2019. The market trend of dysprosium neodymium series products has declined slightly, the supply in the market is normal, the recent demand for light rare earth is general, and the market price has fallen slightly. The price fluctuations of the rare earth market are related to environmental protection inspections across the country. The production of rare earths is special, especially the radiation hazards of some products make strict environmental protection supervision. Recently, certain restrictions have been placed on transportation, and the price trend of some rare earth products has remained stable.

According to the Ministry of industry and information technology and other documents, by 2025, the sales of new energy vehicles will account for about 25%. Global electrification is stepping into the acceleration period of high-quality models at the supply side. China's double point policy and European carbon emission requirements have established a long-term development mechanism for new energy vehicles. Driven by national policies, the supply and demand pattern of rare earth industry is expected to further improve, domestic demand in China has improved, and the price of heavy rare earth in domestic rare earth market remains high. Recently, the Ministry of natural resources and the Ministry of industry and information technology issued the notice on the issuance of the total amount control index (the first batch) for the exploitation of rare earth ores and tungsten ores in 2020, which clarified that the total amount control index for the exploitation of the first batch of rare earth ores (rare earth oxide REO) in China is 66,000 tons, and the total amount control index for the exploitation of tungsten concentrate (65% of tungsten trioxide) is 52,500 tons.

The rare earth analysts of SunSirs predict that the recent strict investigation of domestic environmental protection will continue, the supply of medium and heavy rare earths will be tight, and the supply and demand pattern will change. It is expected that the prices of heavy rare earths in the rare earth market will continue to rise, and the prices of light rare earths will continue to decline.

If you have any questions, please feel free to contact SunSirs with support@sunsirs.com.

- 2024-02-21 SunSirs: On February 20th, Prices of Some Domestic Praseodymium Neodymium Series Products Declined

- 2024-01-25 SunSirs: On January 24th, the Domestic Price Trend of Praseodymium Neodymium Series Was Temporarily Stable

- 2023-12-21 SunSirs: On December 20th, Prices of Some Domestic Praseodymium Neodymium Series Products Declined

- 2023-12-07 SunSirs: On December 6th, Prices of Some Domestic Praseodymium Neodymium Series Products Declined

- 2023-11-24 SunSirs: On November 23rd, the Price Trend of Praseodymium Neodymium Series in China Declined